The Best Strategy To Use For Paul B Insurance Medicare Agency Huntington

Wiki Article

Paul B Insurance Local Medicare Agent Huntington Can Be Fun For Everyone

Table of ContentsAll about Paul B Insurance Medicare Advantage Agent HuntingtonPaul B Insurance Medicare Agent Huntington - The Facts4 Simple Techniques For Paul B Insurance Insurance Agent For Medicare Huntington10 Simple Techniques For Paul B Insurance Medicare Agency HuntingtonThe Only Guide for Paul B Insurance Medicare Supplement Agent HuntingtonNot known Incorrect Statements About Paul B Insurance Medicare Health Advantage Huntington

For some measures, in 2022, if the score on that action was lower than the previous year, the ratings returned back to the 2021 value to hold strategies harmless. An additional 2 percent of enrollees are in strategies that were not ranked since they are in a plan that is as well brand-new or has also low registration to receive a score.

The celebrity scores displayed in the figure above are what beneficiaries saw when they selected a Medicare strategy for 2023 and also are various than what is used to establish reward payments. In the last few years, Med, political action committee has increased issues regarding the celebrity ranking system and top quality bonus program, including that celebrity ratings are reported at the contract as opposed to the strategy degree, and also might not be a helpful sign of top quality for beneficiaries since they consist of way too many actions.

Pick a Medicare Supplement strategy (Medigap) to cover copayments, coinsurance, deductibles, as well as other expenditures not covered by Medicare.

The Greatest Guide To Paul B Insurance Local Medicare Agent Huntington

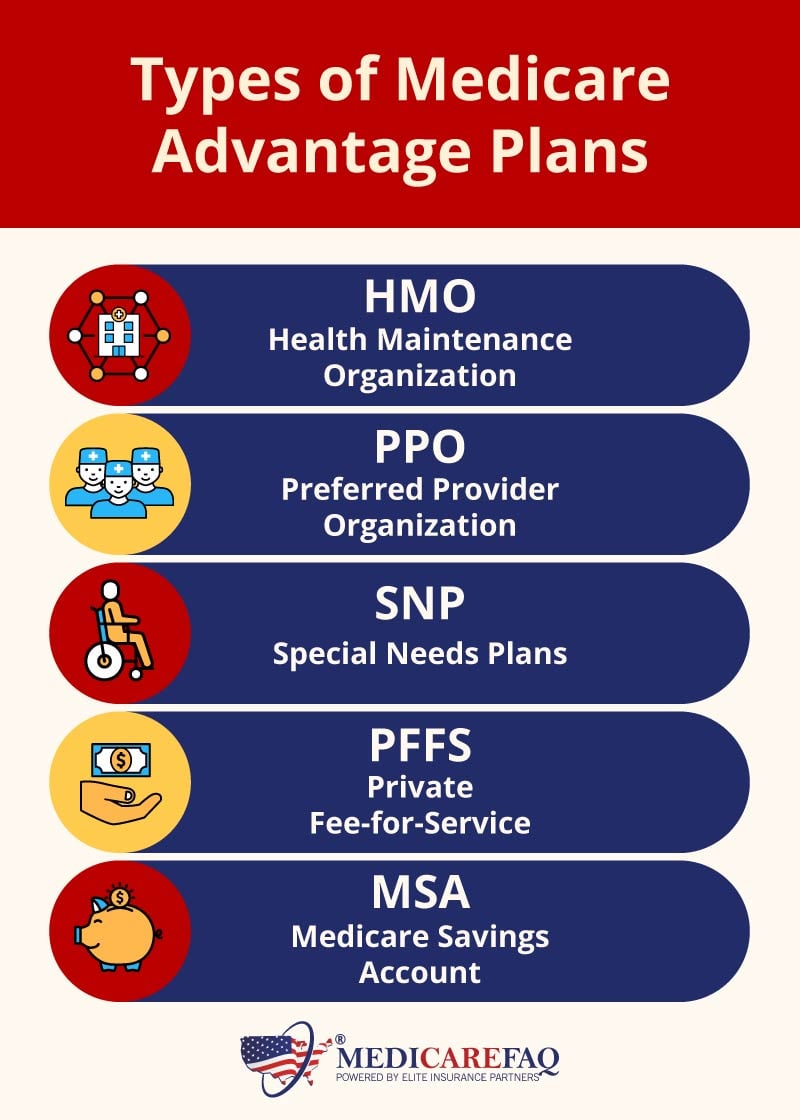

An HMO might require you to live or work in its solution area to be eligible for coverage. HMOs frequently give incorporated care and also focus on prevention as well as wellness. A kind of plan where you pay much less if you utilize doctors, healthcare facilities, and other healthcare providers that come from the plan's network.A type of health insurance plan where you pay less if you utilize companies in the plan's network. You can utilize doctors, healthcare facilities, and also carriers outside of the network without a recommendation for an added expense.

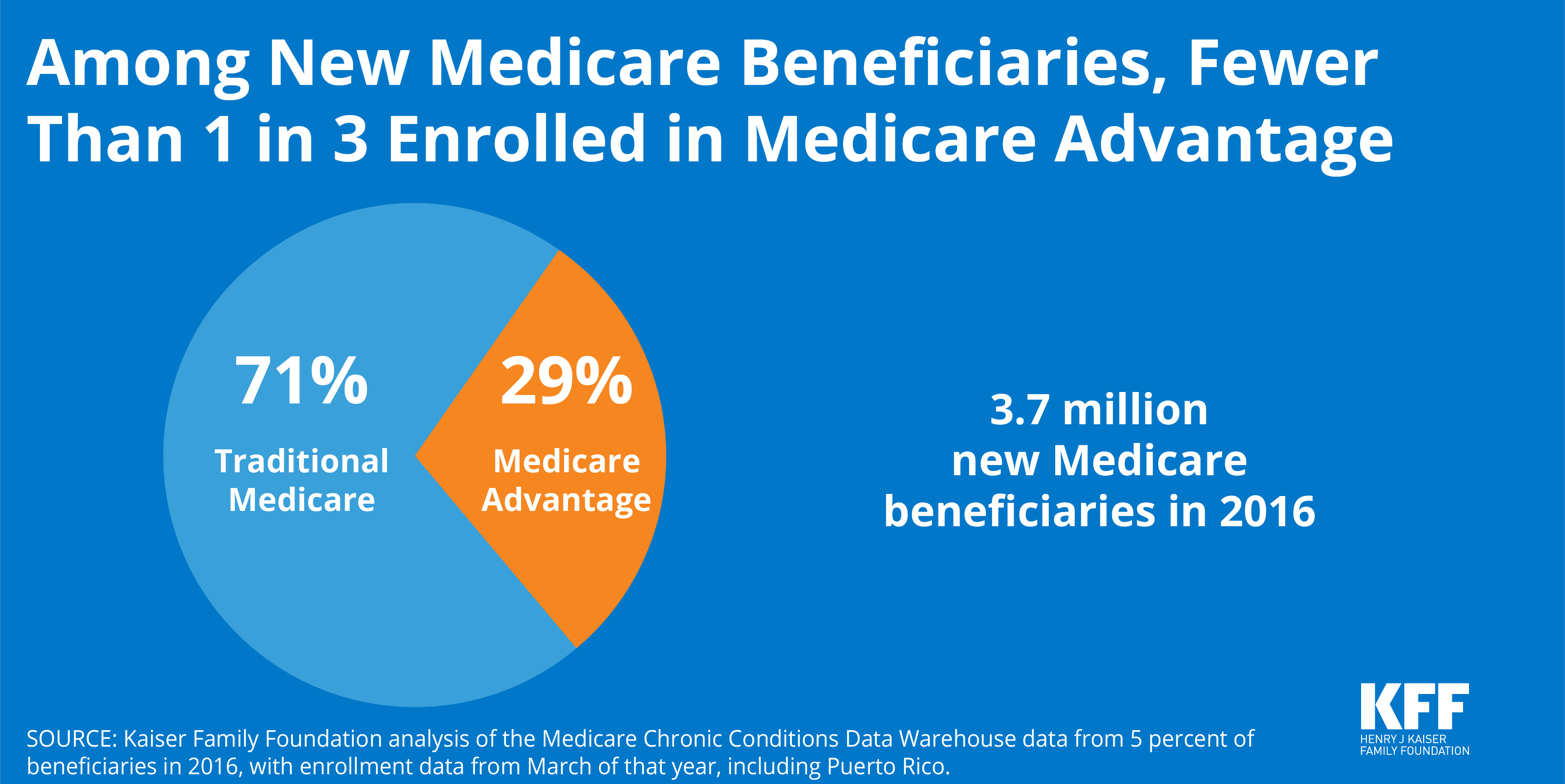

Having a common source of treatment has been located to improve top quality and decrease unneeded treatment. The bulk of people age 65 and also older reported having a typical service provider or area where they obtain care, with a little greater rates among people in Medicare Advantage intends, people with diabetic issues, and also individuals with high needs (see Appendix).

The Single Strategy To Use For Paul B Insurance Medicare Insurance Program Huntington

There were not statistically substantial distinctions in the share of older grownups in Medicare Benefit plans reporting that they would certainly always or often get an answer about a medical concern the exact same day they contacted their usual source of treatment contrasted to those in typical Medicare (see Appendix). A bigger share of older adults in Medicare Advantage strategies had a healthcare expert they could easily contact in between doctor gos to for suggestions concerning their wellness condition (information not revealed).Analyses by the Medicare Settlement Advisory Payment (Med, PAC) have revealed that, generally, these plans have lower medical loss proportions (suggesting greater earnings) than various other kinds of Medicare Benefit strategies. This shows that insurance providers' passion in offering these populations will likely remain to grow. The findings likewise elevates the imperative to analyze these strategies independently from other Medicare Advantage intends in order to guarantee top notch, fair treatment.

Particularly, Medicare Benefit enrollees are much more likely than those in typical Medicare to have a treatment strategy, to have someone that evaluates their prescriptions, and also to have a regular medical professional or area of treatment. By supplying this added aid, Medicare Advantage strategies are making it much easier for enrollees to get the help they need to manage their healthcare problems. More hints

Paul B Insurance Medicare Advantage Plans Huntington Can Be Fun For Anyone

The survey results additionally question about whether Medicare Advantage plans are getting proper settlements. Med, political action committee estimates that plans are paid 4 percent even more than it would cost to cover similar people in traditional Medicare. On the one hand, Medicare Advantage intends appear to be providing services that aid their enrollees handle their treatment, as well as this included care monitoring might be of substantial worth to both strategy enrollees as well as the Medicare program.Part B complements your Part An insurance coverage to supply insurance coverage both in and also out of the hospital. Component An and also Part B were the first components of Medicare developed by the federal government. This is why both parts with each other are frequently referred to as "Original Medicare." Furthermore, the majority of people that do not have added coverage via a team plan (such as those offered by companies) usually sign up for Components An and also B at the exact same time.

Our Paul B Insurance Medicare Part D Huntington PDFs

try this site The amount of the costs differs amongst Medicare Advantage strategies. Medicare Benefit places a limit on the amount you pay for your protected medical treatment in a provided year.And also these networks can be much more effective in delivering care. Therefore, they minimize general healthcare prices. Some Medicare Advantage prepares require you to use their network of house insurance suppliers. Others enable you to head to out-of-network service providers, normally for a greater expense. As you explore your alternatives, think about whether you wish to continue seeing your existing medical professionals when you make the switch to Medicare.

Some Known Details About Paul B Insurance Medicare Part D Huntington

What Medicare Supplement prepares cover: Medicare Supplement plans help manage some out-of-pocket expenses that Original Medicare doesn't cover, consisting of copayments and deductibles. That indicates Medicare Supplement plans are only available to people that are covered by Initial Medicare. If you choose a Medicare Benefit plan, you're not eligible to purchase a Medicare Supplement strategy.Report this wiki page